Indexed

Universal Life

Insurance

Coast 2 Coast Coverage, LLC

Planning for the future can be daunting, but protecting your family’s financial security doesn’t have to be. IUL Insurance provides peace of mind by offering lifelong coverage and potential cash value growth, ensuring that your loved ones are protected while you build a flexible financial safety net.

Anthony S., 34, Texas

⭐⭐⭐⭐⭐

After buying our first home, my biggest fear was something happening to me and leaving my wife with the mortgage. Jesse walked us through our options and helped us get a plan that would pay off the house if I passed unexpectedly. It’s honestly one of the best decisions we’ve made as homeowners.

Happy Customers

More than clients taken care of!

Indexed Universal Life Insurance

Coast 2 Coast Coverage, LLC

Planning for the future can be daunting, but protecting your family’s financial security doesn’t have to be. IUL Insurance provides peace of mind by offering lifelong coverage and potential cash value growth, ensuring that your loved ones are protected while you build a flexible financial safety net.

About Us

Helping You To

Manage Your IUL

Insurance Needs!

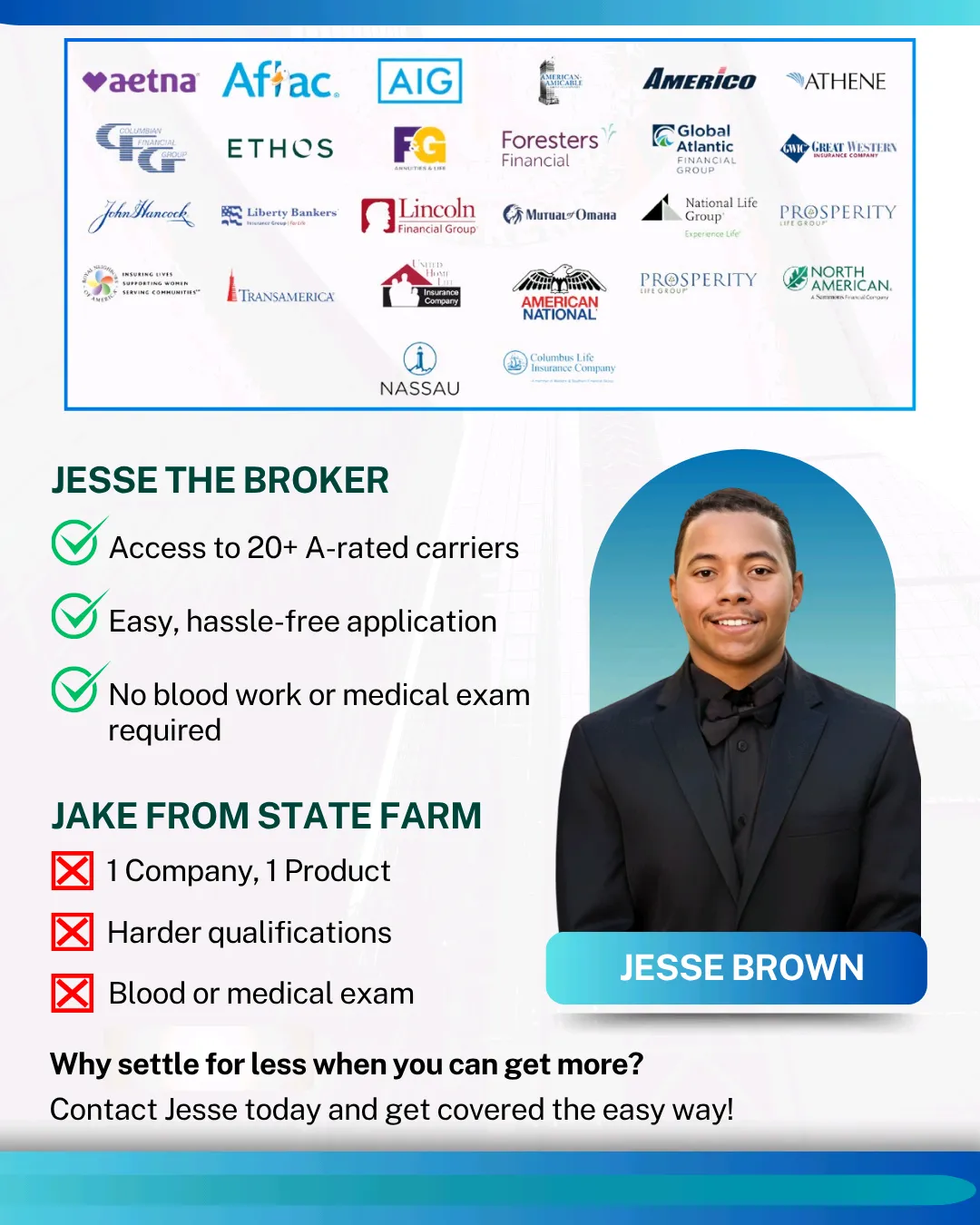

Licensed life insurance agent helping families protect what matters most with Final Expense, Mortgage Protection & IULs. Book a call today—your future deserves a plan.

Jesse Brown

Jesse

NPN: 21411512

About Us

Helping You To

Manage Your IUL Insurance Needs!

Licensed life insurance agent helping families protect what matters most with Final Expense, Mortgage Protection & IULs. Book a call today—your future deserves a plan.

Jesse Brown

Jesse

21411512

Everything You Need To Know

About IUL Insurance

At A Glance

What is Indexed Universal Life Insurance?

IUL Insurance provides lifelong coverage with cash value growth tied to market performance, allowing you to protect your family and build savings with flexible premiums.

Important Details

IUL offers coverage while accumulating cash value, which can be accessed for retirement, emergencies, or other needs. It’s a flexible plan for long-term financial security.

Everything You Need To Know About

IUL Insurance At A Glance

What is Indexed Universal Life Insurance?

IUL Insurance provides lifelong coverage with cash value growth tied to market performance, allowing you to protect your family and build savings with flexible premiums.

Important Details

IUL offers coverage while accumulating cash value, which can be accessed for retirement, emergencies, or other needs. It’s a flexible plan for long-term financial security.

Reviews

Real-Life Testimonials

From Satisfied Clients

Anthony S., 34, Texas

After buying our first home, my biggest fear was something happening to me and leaving my wife with the mortgage. Jesse walked us through our options and helped us get a plan that would pay off the house if I passed unexpectedly. It’s honestly one of the best decisions we’ve made as homeowners.

Brianna L., 41, California

I didn’t want to leave my kids with a financial burden when I’m gone. Jesse made it so simple to get covered — no medical exam, affordable monthly payment, and peace of mind knowing my funeral costs are taken care of. Now I feel relieved knowing my family won’t have to struggle.

Daniel M., 48, Florida

I’ve owned my own business for over 10 years, and this was the first time I felt confident about retirement. Jesse helped me set up an IUL that’s growing every year—no market risk, no taxes. Total game changer.

Reviews

Real-Life Testimonials

From Satisfied Clients

Anthony S., 34, Texas

"After buying our first home, my biggest fear was something happening to me and leaving my wife with the mortgage. Jesse walked us through our options and helped us get a plan that would pay off the house if I passed unexpectedly. It’s honestly one of the best decisions we’ve made as homeowners."

Brianna L., 41, California

"I didn’t want to leave my kids with a financial burden when I’m gone. Jesse made it so simple to get covered — no medical exam, affordable monthly payment, and peace of mind knowing my funeral costs are taken care of. Now I feel relieved knowing my family won’t have to struggle."

Daniel M., 48, Florida

"I’ve owned my own business for over 10 years, and this was the first time I felt confident about retirement. Jesse helped me set up an IUL that’s growing every year—no market risk, no taxes. Total game changer."

More Info

Important Questions

Is Indexed Universal Life Insurance Right for Me?

IUL Insurance is ideal if you want lifelong coverage with the potential for cash value growth. It’s a flexible option that lets you adjust your premiums and death benefit, making it suitable for those who want both protection and a financial growth opportunity.

How Much Coverage Do I Need?

The amount of coverage depends on your financial goals and the needs of your beneficiaries. IUL policies can be customized, allowing you to choose a coverage amount that provides security for your family while meeting your budget.

Is a Medical Exam Required?

In many cases, a medical exam may be required for IUL Insurance, especially if you're looking for higher coverage amounts. However, some policies may offer simplified underwriting for lower coverage limits.

Can I Access the Cash Value?

Yes, you can access the cash value accumulated in your IUL policy. It can be used for various financial needs, such as supplementing retirement income, covering unexpected expenses, or funding education.

How do I Sign Up?

You can start by scheduling a consultation to discuss your needs with an insurance expert. They’ll help you customize your IUL policy and guide you through the application process.

More Info

Important Questions

Is Indexed Universal Life Insurance Right for Me?

IUL Insurance is ideal if you want lifelong coverage with the potential for cash value growth. It’s a flexible option that lets you adjust your premiums and death benefit, making it suitable for those who want both protection and a financial growth opportunity.

How Much Coverage Do I Need?

The amount of coverage depends on your financial goals and the needs of your beneficiaries. IUL policies can be customized, allowing you to choose a coverage amount that provides security for your family while meeting your budget.

Is a Medical Exam Required?

In many cases, a medical exam may be required for IUL Insurance, especially if you're looking for higher coverage amounts. However, some policies may offer simplified underwriting for lower coverage limits.

Can I Access the Cash Value?

Yes, you can access the cash value accumulated in your IUL policy. It can be used for various financial needs, such as supplementing retirement income, covering unexpected expenses, or funding education.

How do I Sign Up?

You can start by scheduling a consultation to discuss your needs with an insurance expert. They’ll help you customize your IUL policy and guide you through the application process.

Looking for a First-Class IUL Insurance Consultant?

Looking for a First-Class IUL Insurance Consultant?

Coast 2 Coast Coverage, LLC is committed to serving you at the highest level with all your Indexed Universal Life Insurance needs.

National Producer Number: 21411512

Company

Directories

Legal

Coast 2 Coast Coverage, LLC is committed to serving you at the highest level with all your Indexed Universal Life Insurance needs.

National Producer Number: 21411512

Company

Directories

Legal